The ‘black’ hole in Robert F. Kennedy Jr.’s housing conspiracy theory

“BlackRock + State Street + Vanguard are robbing Americans of the ability to own homes.”

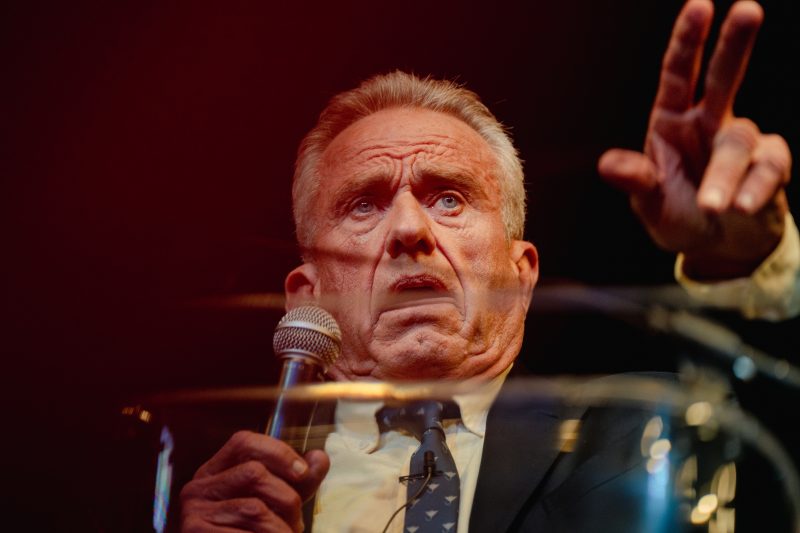

— Independent presidential candidate Robert F. Kennedy Jr., in a tweet, Sept. 3

“How can our kids or the typical American homeowner win a bidding war with BlackRock? … BlackRock wants to be everybody’s landlord and everybody’s neighbor. But I’m not going to let that happen.”

— Kennedy, in a campaign video, Sept. 2

“BlackRock! There’s three companies. BlackRock, Vanguard and State Street. Those three companies, which all own each other, so it’s really one huge behemoth, also own 88 percent of the S&P 500. Now they have a new target, which is to gain ownership of all of the single-family residences in this country.”

— Kennedy, in a campaign speech, Aug. 27

Kennedy, who is running for president as an independent, is best-known these days for spreading dangerous conspiracy theories that vaccines cause autism and that the coronavirus could have been a bioweapon “deliberately targeted” to spare Ashkenazi Jews and Chinese people while disproportionately attacking White and Black people. Now he has a new one — evil institutional investors are driving up home prices.

In a campaign video titled “I’ll help you buy a home,” Kennedy especially targets a company called BlackRock, saying that when houses come on the market, it “swoops in” and outbids prospective home buyers with “all-cash offers” and turns the homes into rentals. He also often includes two other investment firms, Vanguard and State Street, in his critique.

The housing crisis in the United States is real — there are too few homes on the market, sending prices soaring — but Kennedy’s claims are financially illiterate poppycock. He gets so many things wrong that it’s hard to know where to begin. But we will start with the most apparent problem: He’s mixing up two companies. BlackRock is not in the business of buying single-family homes. That would be another company — Blackstone. But Blackstone doesn’t buy enough homes to have much effect on the market.

In an email, Kennedy’s campaign acknowledged this elemental mistake, but made more errors as it then doubled down on his claims.

“Mr. Kennedy misspoke,” the campaign statement said. “He knows both BlackRock and Blackstone were founded under the Blackstone Financial Management umbrella. In addition, the largest shareholder of Blackstone is Vanguard, and the largest shareholder of Vanguard is BlackRock. It would be disingenuous to claim BlackRock isn’t in the business of profiting from buying up American homes, if that is the point Mr. Kessler is trying to make.”

That connection between BlackRock and Blackstone ended in 1994 — almost 30 years ago. A lot has changed since then.

BlackRock is run by Larry Fink. In 1988, he created a subsidiary that traded mortgages and other fixed-income assets under the Blackstone corporate umbrella. But six years later, Fink had a dispute with Blackstone’s chief executive, Stephen A. Schwarzman, over compensation. So Schwarzman sold the subsidiary, then called Blackstone Financial Management, to a bank for $240 million. Fink renamed the company BlackRock, and a few years later it became independent.

In 2013, Schwarzman said the decision to ends ties with BlackRock was “certainly a heroic mistake.” Both firms are publicly traded, and BlackRock now is worth more than Blackstone. BlackRock’s market capitalization currently is $111 billion while Blackstone’s market capitalization is $81 billion. Schwarzman is rather rich — worth $27 billion according to Forbes magazine — but his previous 9 percent ownership of what is now BlackRock would have added an additional $10 billion to his net worth.

Despite their similar names, the companies have evolved into very different firms. Blackstone specializes in private equity and alternative investments. That means Blackstone executives actively seek out good investment opportunities, which may take years to pay off, usually on behalf of institutions and wealthy individuals who pay hefty fees for Blackstone’s expertise.

Meanwhile, BlackRock has become the world’s largest asset manager, but its investments are largely passive. It sells mutual funds and funds traded on stock exchanges (under the IShares brand) that mimic stock indexes, such as the Standard & Poor’s 500 Index. The S&P 500 tracks the 500 largest companies traded on U.S. stock exchanges. No investment research is needed, so the fees BlackRock charges are paper-thin.

There are three companies that dominate the index-fund market — BlackRock, Vanguard and State Street. Not coincidentally, those are the companies that Kennedy regularly attacks. But none of them invest in single-family homes.

Kennedy claims the companies “own 88 percent of the S&P 500” and “all own each other.” He is mischaracterizing a 2017 study that found that together the three firms make up the largest shareholder in 88 percent of the S&P 500 firms and 40 percent of all companies listed on U.S. stock exchanges. That does not mean they have control of those companies; the average ownership of the three firms combined was almost 18 percent in the firms where they were the largest shareholder.

It’s important to note that these firms hold these shares on behalf of millions of investors; if you have a 401(k) retirement fund and invest in an index fund, it is likely managed by one of these three companies. But the firms effectively have the voting authority of those shares. Some on the right, such as GOP presidential hopeful Vivek Ramaswamy, have charged that the firms used their market power to foist environmental, social and governance agendas on companies. But that’s a different matter from the one Kennedy raises — and the three companies have responded to the concerns by increasingly giving investors in the funds the option to vote their shares as they wish.

As for owning each other, Vanguard is a private company and it’s owned by the people who invest in its funds. BlackRock and State Street can’t invest in it. But BlackRock and State Street are public companies and are part of the S&P 500. (BlackRock is the 74th largest company in the index portfolio and State Street is the 297th largest company.) In other words, simply in the process of buying shares in companies to mimic the indexes, the three companies would end up owning shares of BlackRock and State Street.

“We do not purchase single- or multifamily housing,” said Netanel Spero, a Vanguard spokesman. “We also operate in a unique, investor-owned structure where Vanguard fund shareholders own the funds, which, in turn, own Vanguard. The money we manage belongs to our 50 million individual investors.”

Some companies attacked by Kennedy would not comment for the record, not wanting to get into a political fight. But BlackRock has a webpage headlined: “We want to make perfectly clear: BlackRock is not buying individual houses in the U.S.” The page says the company is a “significant investor in mortgage securities, helping make capital available to individuals and families seeking to purchase homes” and has “invested in several programs that are providing financing to build new homes and add to U.S. housing supply.”

Okay, we’ve established that Kennedy’s claims about the three index-fund companies are false. But, if he ever managed to get the name right, is he correct about Blackstone’s power in the housing market? No.

Blackstone initially got into the real estate business after the Great Recession in 2009, when many banks found themselves holding toxic mortgages, primarily in the Sun Belt. Blackstone bought foreclosed houses, fixed them up and rented them out again. But it exited that market in 2019 when it sold its last shares in a company, Invitation Homes, that managed leases on about 80,000 homes.

Then, in 2021, the company spent $6 billion to buy Home Partners of America. Single-family homes had become a hot commodity after the pandemic led people to seek larger living spaces.

In his campaign video, Kennedy asserts that the company steals homes from potential buyers just as they are about to buy one. That’s the opposite of what happens.

A potential home buyer — perhaps unable to immediately buy a home they like — contacts Home Partners. The firm then buys the house and in turn rents the home to the buyer — who retains an option for as long as five years to buy the house outright at a guaranteed purchase price. Many Home Partner residents have a lower median FICO score than the typical home buyer, the company says, as an indication that it is making it easier for people who otherwise could not afford a single-family property.

As for claims of market influence, Blackstone disputes that on a webpage that addresses what it calls “myths” about its business. Citing statistics from real estate specialist John Burns Research & Consulting, it notes that institutions that own more than 1,000 homes make up 0.4 percent of the U.S. single-family housing stock — and Blackstone owns 0.03 percent.

In an April report, the Urban Institute calculated that such mega-investors owned almost 446,000 properties, while smaller investors (between 100 and 1,000 homes) owned almost 20,000 homes. Other institutional investors bring the total to about 600,000 homes, or about 3 percent of the nation’s 17 million single-family rental homes. The analysis found that the investors were heavily concentrated in some fast-growing areas, such as Atlanta and Jacksonville, Fla. Institutional investors own 10 percent of all single-family rental properties in Atlanta and 8.5 percent in Jacksonville, the study said. (The report did not identify specific mega-investors such as Blackstone.)

“The evidence does not support the contention that institutional investors have a major impact on home prices,” said Paul Fiorilla, director of research at Yardi Matrix, a data provider in the commercial property/single family rental sector. “Any segment that owns such a small percentage of the market cannot have that much of an impact on prices,” with the possible exception of a handful of communities with a significant concentration of big investors.

Moreover, the sharp increase in mortgage interest rates engineered by the Federal Reserve has cooled the ardor of institutional investors. Landlords with 1,000 properties or more accounted for 0.4 percent of U.S. home purchases during the second quarter, down from a peak of 2.4 percent in late 2021, according to John Burns Research & Consulting.

“When mortgage rates went up, suddenly the math to support scattered site home purchases didn’t make sense anymore,” Fiorilla noted. “If institutions were the cause of rising home prices and they stopped buying in the past year, then prices would go down, right? But home prices haven’t changed that much, because the increase in home values is mainly a function of demand exceeding supply.”

Let’s recap: Kennedy gets wrong the name of one company he is attacking; he incorrectly slams index-fund investment firms that do not buy single-family homes; he falsely says Blackstone steals homes from potential buyers, and he make unsubstantiated claims of market manipulation by institutional investors.

That’s par for the course for a conspiracy theory. Kennedy earns Four Pinocchios.

(About our rating scale)

Send us facts to check by filling out this form

Sign up for The Fact Checker weekly newsletter

The Fact Checker is a verified signatory to the International Fact-Checking Network code of principles